|

|

||||||

|

growing

like nuts |

index | ||||||

|

|

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

| NOTE!

One day older accumulation data than shown on the present web page

(with month report data) have been provided in a separate Excel

file by VREG, status March 1, 2012. See section

II of the Year Overview section of Flanders market review! |

Older material on previous web page

Flanders/Vlaanderen: (23 graphs, incl. interactive)

2010 onwards - overview and details

Market growth 2011 - preliminary results table

Capacity

growth (MWp) and growth in Wp/inhabitant, incl. NL

Capaciteitsgroei

(MWp) en groei in Wp/inwoner, incl. NL 2

interactive graphs

PV

has most capacity installed in renewable electricity

PV grootste opgestelde capaciteit bij hernieuwbare stroom 1

graph

Distribution

among PV-installations >10 kWac

Installaties groter

dan 10 kWac in Vlaanderen: verdeling

(accumulating data and new installations/period, respectively)

3 graphs

Distribution

among PV-installations < 10 kWac

Installaties

kleiner of gelijk dan 10 kWac in Vlaanderen: verdeling 2

graphs

Average

daily new capacity per month in small and large category

Gemiddelde dagelijkse

bijbouw per maand in zowel kleine als grote categorie

3 graphs

Additions

to the >10 kWac list - status

Toevoegingen aan de >10 kWac lijst - status

Flanders - renewable electricity

mix shows clear PV component

Zonnestroom reeds duidelijk aanwezig in de hernieuwbare stroommix

5 graphs

More

details on Flanders PV market

Wetenswaardigheden over de Vlaamse PV markt

Photo's:

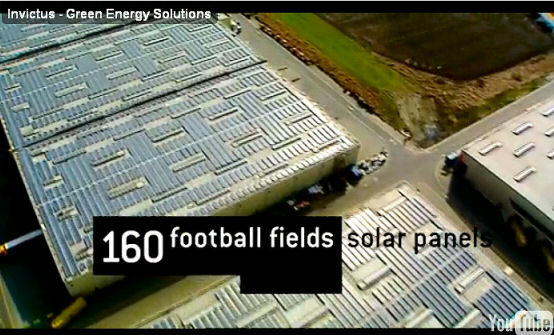

Harelbeke 5,004 MWp flat roof project by Orka

Loghidden

City first modules (Katoen Natie portion of 40 MW multi-site

project)

770 kW Juma Beton project in Lommel

1.014 kW Mechelse

Veiling project in Sint-Katelijne-Waver

Loghidden City video still

(from Invictus company video)

Solar power plants for locks

- example Albert Canal

Biggest Benelux free-field

installation Nyrstar 7,6 MWp (or bigger?)

Small is beautiful - example

in the ancient heart of Gent

Specials:

Katoen Natie (2 graphs)

Map with private PV-installations

(map)

Big Players in Flanders (table)

Official

date of VREG approval for

projects >10 kWac (3 graphs)

>10 kWac projects

per net manager region (1 graph)

The rest of Belgium/de rest van België:

Wallonië/Region Wallonne (3 graphs)

Brussel/Bruxelles (2 graphs)

Estimation

for PV-capacity (growth in) in Belgium

Schatting PV-capaciteit geheel België

English

summary for 2010 on Solarplaza.com

(external link, status March 1, 2011, see also pdf)

English

summary for 2009 on Solarplaza.com

(external link, status April 1, 2010, see also pdf)

Voor

ontwikkeling Nederlandse markt zie de aparte

pagina NL

(For Dutch market details look

here)

*

Update resulting from last status report date-stamped February 1, 2012

on VREG site, and

older VREG data (year reports of previous years, monhly updates as of

Feb. 2011)

Vlaanderen/Flandres ("Vlaamse Gewest")

VREG - PV in Flanders (PV in Vlaanderen) update up till March 2, 2012 (downloaded: March 9, 2012)

Summary according to VREG registrations: Highlights: March 2, 2012 report: 1,5 GW AC capacity accumulation in Flanders surpassed. January 1, 2012 report: over 500 MWac market growth in 2011 established, already far beyond 2009 level; ING Equipment Lease portfolio surpasses 50 MWac. December 1, 2011 report: 23rd Katoen Natie subproject (652 kWp) in Western Schelde harbour region added. November 1, 2011 report: First new Katoen Natie project in Antwerp added. September 2011: > 1 GW of AC capacity formally registered with VREG. June-July 2011: probably 1 GWp of nominal DC capacity surpassed (Aug. 1: 969 MWac). March 2011: 100.000 PV-installations in Flanders surpassed. Biggest free-field PV-installation of Benelux included (6,2 MWac Nyrstar project). Accumulated capacity up till December 31, 2011 (VREG update/review March 2, 2012*): 1.538,258 MWac with 177.826 registered "installations"**. Average size of all installations: 8,65 kWac/entry. Accumulated capacity up till December 31, 2010, according to latest month report revision (ibid): 890,498 MWac with 98.228 registered "installations". Accumulated total capacity up till December 31, 2009 (ibid): 546,070 MWac with 65.300 registered "installations". 2011

growth - Preliminary market growth of installations explicitly

assigned to 2011 by VREG in the period January 1, 2011 up till December

31, 2011: 647,760 MWac with 79.598 Most probably due to degressions of the value of green certificates for solar electricity, the first one starting on July 1, 2011, market growth in Flanders has been remarkable as of May 2011. Many new large-sized installations were reported by VREG with date-stamps of official start in May and, in particular, in June 2011. In the March 2, 2011, report, for that last month only 734 new installations >10 kWac were reported by VREG with a capacity of 192 MWac (average size: 262 kWac per registered installation), with probably considerable backlog not yet published by VREG. Note that this volume already is 14% beyond the level of previous record month December 2009 (168 MWac). 2010 - Preliminary market growth for 2010, based on new data published by VREG as of March 2, 2011: 344,428 MWac with 32.928 "installations" (average size new installations 2010: 10,46 kWac/entry). Almost 46% (157 MWac) has been registered in December of that year. 2009 - Preliminary ("near definitive") market growth for 2009 (dramatically increased with respect to 2009 year report published May 2010, with only 245 MWac then known): 453,306 MWac with 49.963 "installations" (average size new installations 2009: 9,07 kWac/entry). Also, a large contingent of that volume (168 MWac, 37%) has been registered by VREG in the last month of that year (and formally accepted as such if the final grid connection for that volume was approved up till the end of February 2010). Total growth in period 2009-2010: 797,734 MWac with 82.891 newly registered entries (further changes expected with additional backlog being registered in future VREG reports, although large volumes are not expected). 2009 claimed 56,8% of the new MWac volume in those two years, but with all backlog capacities published by VREG in new month reports, 2011 has already surpassed 2009 with much larger volumes of newly installed capacity and installations. The March 2, 2012, report added almost 76 MWac of new capacity with respect to the previous month overview. 58 MWac of that new volume (76%) has been assigned to 2011. The rest has been assigned evenly to earlier years, 8,3 MWac, and only 9,3 MWac to 2012 (12% of new volume). Installations with a capacity of max. 10 kWac registered by VREG make up 54,0% of the (documented) Flemish PV-market and have an average size of 4,73 kWac. 3.382 (large-sized portions of) installations registered with VREG have an inverter capacity >10 kWac (status March 2, 2012). The biggest "single-site" installation remains the multi-roof Loghidden City terminal of Katoen Natie (Schelde West Bank) with at least 27,92 MWac inverter capacity (22 large sections). A first new large (1,02 MWac) solar Katoen Natie project in the Antwerp region east of the Schelde was added in the November 1, 2011 VREG report. Other developers did the same in the Antwerp and Gent harbour regions (e.g., ISP1-RG NV projects under the ING Equipment Lease umbrella). Heusden-Zolder 4,704 MWac Zonnecentrale Limburg NV, for a long time the largest free-field installation registered as such by VREG, has been replaced by a 6,2 MWac large entry for Zonnecentrale Overpelt NV (Nyrstar project) in 2011. Sofar, this free-field installation is the largest realised - and officially registered - project of its kind in the Benelux. In the September 1, 2011 report, two new installations of >4 MWac were added, the "Solar Tunnel" above a high-speed train traject near Antwerp, and 4,5 MWac Zonnecentrale Tongeren. * Still not definitive numbers. Data can - in particular for most recent years will - change in coming monthly overviews and year reports. ** Certified, registered with VREG, and prone to receive green certificates for the electricity produced. Note, that many larger PV-systems are not reported "as one system", but as two or more separate entries in the VREG registrations. The biggest "multi-roof" installation on one site, the huge Loghidden City Complex on the western Schelde shore (Kallo Kieldrecht, community Beveren-Waas), and part of the 40 MW Katoen Natie super project, has been split into at least 22 separate parts (varying in size between 210 and 1.804 kWac in the VREG reports) filed under the name of several daughter companies of the Katoen Natie holding (status: March 2, 2011). Similar split-ups appear in the Desteldonk area of Gent for the Katoen Natie project (the biggest segment a 2.220 kWac portion under the flag of Sabeen NV, a Katoen Natie subsidiary assigned to Sint-Kruis-Winkel in the northeastern Gent harbour region). Accompanied by a variety of other big installations not (directly) under the Katoen Natie flag, that have been registered by VREG under separate entries with their own code numbers. In the VREG reports, the "entries" are referred to in Dutch as "productie-installaties" (installations for production of renewable electricity deemed worthy of receiving guarantees of origin). |

Results from the market statistics produced by the "Vlaamse Reguleringsinstantie voor de Elektriciteits- en Gasmarkt" (VREG) for PV market development in Flanders. Statistics are frequently refreshed on VREG's website, but sometimes have lagged behind 1-2 months in recent years due to serious work overload at the regulator's office. Since April 2010 there has been a continuous update per month, although month reports can lag behind for a longer period. It must be emphasized here that older "numbers" reported by VREG can still be updated afterwards, as can be found in the [updated] year reports by the regulatory authority, and also, since 2011, in extensive, updated month reports. Hence: earlier published year accumulation for PV-capacity, can change as a backlog of installations not yet covered for that year is added even years later. This was particularly so for the data for 2009, that VREG first revised officially in their Feb. 28, 2011 month report (dramatically increasing capacity and installation numbers for 2009 compared to the original 2009 year report). This realisation made Polder PV update his earlier data on basis of VREG's yearly reports, and update his graphs published sofar. Updates will be further provided with each month report if time allows.

Graphs made by Polder PV from the principal VREG data (and other sources) are found directly below (roll-over image). Data for earlier years (up to 2004 from graph published by ODE, this webpage) have been replaced by new VREG data published since the Feb. 28, 2011 report. The latter report has been the first reference for new and more detailed analysis, which are augmented by new data in detailed monthly reports as of March 2011. Note: data in these graphs are only for the "Vlaamse Gewest", the Flanders territory excluding Brussels, and also not including the large French speaking Walloon region. See the separate sections for these areas on this webpage. A first analysis for the Belgium market "as a whole" has been published by Polder PV in articles published for the 2010 Solar Future Belgium symposium by SolarPlaza (original article here, pdf with graphs here). The version I wrote for the 2011 SolarPlaza Symposium can be found here (pdf can be found here). Recently, a new extensive status report has been published prior to the Solar Future Belgium '12 conference. This update can be found here (note also comments added below the report by the author; pdf here).

MWac,

not MWp

It is important to note that data published for the Belgium market

relate to maximum inverter capacity involved (kWac), and do not refer

to nominal STC power of the DC generator (kWp), as previously thought,

and still often suggested as such in the media. Polder PV, on asking VREG,

what accumulated MWp [STC] power could be on Flemish soil, got the reply

that this is unknown for many older installations, and that such data

have not yet been compiled by the regulator. A "standard calculation

factor" to obtain MWp power from the registered MWac data is not

used by VREG because of the uncertainties there-in (e-mail reply to webmaster

of Polder PV, March 8, 2011). If one would calculate in a conservative

manner, one could multiply the AC power in the tables and graphs with

a DC generator : AC inverter capacity factor 1,1 (hence: based on the

results published in the March 2, 2012 report, Flanders could have accumulated

1.549 (MWac) * 1,1 = 1.704 MWp of nominal DC power (STC capacity of PV-modules

involved). Earlier results published by VREG have revealed that somewhere

in June of 2011, the 1 GWp nominal STC capacity for photovoltaic installations

could have been "cracked" in Flanders. This remains, however,

an uncertain value as long as VREG is unable to provide more details.

Since VREG always adds new capacity for previous months, it is however

certain that the early summer of 2011 has been the "marker date"

for Flanders to reach the as yet exclusive club of "countries"

or "regions" (don't forget that Flanders is part

of Belgium!) that has more than 1 GWp of PV-installations on its soil

(e.g.: Germany, Italy, Japan, U.S.A. & Spain, China, France, and the

Czech Republic, see also analysis

of EPIA 2011 market report).

Note that reporting new PV capacity to VREG has become more strict, and that AC as well as DC capacity must be reported. The "problem" lies in the DC capacity for many older installations, that is still unknown.

For population data, the number of inhabitants for the Vlaamse Gewest only has been taken ("Vlaamse Gewest" app. 6,3 million, "Vlaamse Gemeenschap" including Brussels would have app. 7,3 million Flemish inhabitants, according to this Wikipedia site). Data for Flanders are compared with data available for the Netherlands in the graphs. For further information please contact the webmaster of Polder PV.

Total market

growth for Flanders in 2009

New calculations had to be done based on the additional

data published by VREG in their February 2011 report and in the later

revisions, in which the capacities per year were continuously updated.

Originally, VREG, published a volume of only 245,051 MWac and 47.273 new

installations for 2009, in their year report for that year (dated May

2010). This has been grossly adjusted in the new data and still is revised

on a monthly basis, although with minor additions in the second half of

2011 (in the order of 0,5-1 MWac per month). This is probably the result

of the fact that many installations have been mounted end of December

2009 without inverters, for which two months extra allowance time in 2010

had been given by the Flemish authorities ("transition period").

This to the effect of finalizing the PV-systems, and to be able to apply

for the "old" 45 Eurocents per kWh (green certificates value),

instead of the 35 Eurocents that became valid for all other new installations

as of Jan. 1, 2010 (up till the end of that year). Possibly VREG originally

counted (part of) those installations finalized before end of February

2010 as belonging to the "2009 cohort".

The latest VREG numbers in the March 2, 2012 year market update are impressive for the Dutch-speaking Flemish region in the relatively small country of Belgium: 49.963 new installations in 2009 (5,7% over the original year report 2009 value), and a respectable 453,306 MWac of new capacity (85,0% over the previously reported volume in the first year report...). Putting that volume equal to 1,1 * 453 = 498 MWp DC capacity, that would roughly be a factor 47 as much as the absolute "growth" in PV capacity (10,7 MWp in 2009, first data CBS) in the (whole of the) Netherlands bordering Flanders in the north.

Year growth

Flanders market

In the graphs presented below I will first give the latest year

results (or: predictions) up till 2011 from the most important sources

for the Flemish market: regulator VREG and (latest data, updated after

an almost year

long "stall" of these important numbers) branche organisation

PV Vlaanderen (former BelPV). All graphs give AC power of installations

(note: deviating from common practice in Germany, where DC power capacities

are published, "Generator Leistung" in kWp, MWp, etc.).

ROLL-OVER

IMAGE. Mouse pointer away from the image shows the

most recent available data from the standard monthly reports by

VREG (revised year data renewable electricity generation capacity

as of March 1, 2012†), and the

data presented by PV-Vlaanderen (former BelPV) branche organisation

in their completely updated "Marktgegevens / cijfers"

section (higher than the numbers in their report "Zonnige toekomst

voor Vlaanderen", publ. January

2012). Mouse pointer over the image shows earlier data from

VREG's year report 2010 (publ. August 5, 2011), and older data by

PV-Vlaanderen that could be found for a long time on their website

in 2011 up till February 2012 (see

also my comments).

For 2010, changes are remarkable, as they were before for 2009. The 2009 year report capacity data have been revised dramatically in the 2010 VREG year report (published August 2011). Older prognoses from PV-Vlaanderen have always been to low, such as happened with branche organisation's estimates in other booming solar markets. The old data that PV-Vlaanderen had on their website for a long time (green columns when mouse pointer is over graph) could still be found on their website in December 2011. They did, however, finally revise the VREG data in their short market overview in November of 2011 (under "cijfers"). The numbers in a separate report, "Een zonnige toekomst voor Vlaanderen", published January 2012, are, however, also outdated ("2010: 316,6; 2011: 430 MWac"). The data presented on their website in March (green, mouse pointer away from the graph) do also not show actual status published by VREG. Numbers for 2011 will certainly increase further as VREG will report more on their backlog entries for that year in the coming months, such has happened for 2010 in the month reports in 2011. Note that capacity in graphs and text is in AC power unless specified otherwise (maximum inverter power of the installations involved). Total installed nominal generator power (MWp STC tested power of all PV-modules) is as of yet unknown for many older installations by market regulator VREG, but could conservatively be taken as 1,1 times AC power. † Data taken from the standard month report, published March 2, 2012. Note that VREG also published a preliminary Excel overview with year data for 2011 dated March 1, 2012, with slightly lower numbers as those in the detail report highlighted on this webpage (e.g., 641,6 MWac accumulation in 2011). See analysis by Polder PV on the separate webpage. |

Yearly added new PV-capacity (grid-connected) in Flanders completely revised by VREG, in their March 2, 2012 month report (mouse pointer away from graph). The changes with respect to previous known "officially published" numbers (mouse pointer over the image) are remarkable for the year 2010: Following data from the year report 2010, VREG originally published preliminary new capacity of 253,8 MWac for 2010. This has been changed into a considerable higher 344,4 MWac in the March 2, 2012 update (almost 36% more capacity than previously published). Even the originally published new capacity for 2009, 445,8 MWac, had to be revised accordingly: the adjusted new capacity published for that year in the March 2, 2012 report now has been adjusted to 453,3 MWac, 1,7% more capacity. Although in theory still volume might be added, it is expected that this will only be a minor volume; the biggest changes in the statistics for a certain year become apparent in the following year.

Branche organisation PV-Vlaanderen (previously BelPV) for a long time implied 412,7 MWac for 2009 (mouse pointer over graph) in a graph originally published in February 2011 (and still on their website up till February 2012), and a preliminary 165 MWac for 2010. They have only recently adjusted market data for 2009 and, in particular for their "way-off" data for 2010. End of 2010 PV-Vlaanderen predicted a small "end-of-year-rush" of possibly 80 MWac in December 2010. Up till the March 2, 2012 report, however, only for the >10 kWac category already 653 installations (or registered portions of large systems) have now been officially designated to that final month of 2010, with a total added capacity of 156,7 MWac. Hence, BelPV apparently published an extremely conservative prediction in contrast to what I thought earlier. The strange thing is, that Jo Neyens of BelPV has been one of the approximately three-thousand people, organisations and companies (status: Jan. 20, 2011) signing the petition to the Flemish government ("Laat de zon schijnen" - "Let the sun shine") to prevent harsh degression measures for the coming feed-in tariffs for PV. In that well-written document, dated November 25, 2010 (one of the authors works for the well-known PV-system planner Enfinity), the old market data by VREG (that I originally took as a basic reference) were also used for the calculations (pages 7-8 of the pdf available through that website). There they also took the VREG year report 2009 data, and the following month reports as "true market data" to calculate the probable volume of kWh's produced (and green certificates to be issued) based on that market growth. It is now apparent, that many calculations will have to be revised since much larger volumes have already been reported in the continuous updates published by VREG.

Preliminary monthly growth Flemish PV-market 2011, status March 1, 2012

Taking the continuously revised new monthly VREG data for PV-installations and capacity assigned to 2011 (March 2, 2012 report, with data up till, and inclusive, Feb. 29, 2012), the following picture emerges:

|

^^^ Accumulated AC capacity for 2011 (dashed) will further grow as new monthly reports by VREG will become available in 2012. Also, the capacity for 2010 and earlier years still can be adjusted afterwards as VREG will still assign installations to those years (expected: minor volumes). Note that in 2011 (more precise: app. June-July), the barrier of 1 GWp accumulated nominal (DC) capacity of PV installations has been broken in Flanders (red line). The 1,5 GWp "barrier" may have already been passed end of 2011. For 2012 data are not yet encouraging. Only 9,3 MWac has been recorded, which brings accumulated capacity at 1.692 MWac, or 1.704 MWp DC for Flanders. |

In this graph end of year (up till 2010) and preliminary 2011 accumulations have been shown. With all 12 month reports by VREG for 2011, the additions in the March 2 report in 2012 (with 58 MWac allocated to 2011), and the revisions there-in, accumulation of all registered installations already has become 1.538,3 MWac. With the addition of a meagre 9,3 MWac assigned to 2012, this adds up to 1.549,385 MWac. If one would take 1,1 as a conservative multiplying factor to calculate the possible DC generator power involved, this could amount to approximately 1.692 MWp end of 2011, and 1.704 MWp with present known 2012 additions (STC power of all PV-modules), as shown in the light blue "open" column on the right for end of 2011. Already far beyond the "magic" 1 GWp (DC) volume that only few other markets - in much larger countries - have reached, reaching out for the next magic barrier, 2 GWp. With an important note: this only concerns Flanders, the Walloon region and Brussels (much smaller partial Belgium markets) are not yet included in these numbers.

According to a recent prognosis by Apere (with preliminary estimates), these much smaller Belgium markets could have added 2011 volumes of 94 and 0,7 MWac, respectively (reaching accumulative capacities of 186 and 6,6 MWac, the Walloon market has doubled). The latest reviews of CWaPE (publication date end of Feb. 2012) show that new capacity in 2011 already could have been in the order of 107 MW (capacity there is given in kVA, kilovoltampère). Only a small volume, 7 MW, consists of installations >10 kVA.

2011

onwards - overview and details

The market segment >10 kWac (status March 1, 2012)

could be analysed in detail. For the first time, in the January 31, 2011

issue, the long installation list (pdf of January 1, 2011 report containing

140 pages) was published as an Excel file. After reworking that file,

it was much easier to compare that listing with the previous one and extract

from the differences the growth data in the intermittent period. Regrettably,

later reports again were pdf files, again later accompanied by Word documents.

With some conversion steps these could be used in updated Excel files

and a comparison with the previous list could be made. This remains, however,

a laborious task demanding meticulous attention. There has been some confusion

with the June 2011 report, for which no Word document was made available.

Therefore, the pdf was screened by Polder PV to extract the new installations

(as of August 2011 again Word documents have been published). Sometimes,

this list is published asynchronously with the other actual data reported

by VREG (e.g., the November 1, 2011 listing was made available only in

the third week of that month).

The accumulated volume for >10 MWac installations ("registered entries") in the March 2, 2012 report consists of 3.382 registrations with an accumulation of 714,2 MWac of inverter power, and an average system (or "entry") size of 211 kWac.

Small system

size/accumulation

Taking the accumulation of installations >10 kWac counted

by me (and included in detailed spreadsheets), and subtracting that volume

from the separate "accumulation for all renewable options" listing

by VREG, it is possible to calculate the share of the installations up

till 10 kWac ("small market segment"). In the March 2, 2012,

report that segment seems to represent an accumulation of 176.710

installations with 835,1 MWac of installed capacity

and an average system size of 4,73 kWac. Calculating

with a factor kWp = kWac * 1,1, average STC generator (DC) size for this

important category could be 5,20 kWp (26

modules of 200 Wp each on a family house).

Growth numbers

PV-categories big and small

Reporting from the results from the last months ("installation"

meaning: "entry registered in the VREG records"). Note that

additions often are assigned to earlier years, up till now only a small

portion of those additions has a date stamp in 2012 (!):

January 2012 (between Jan. 1, 2012 and Jan. 31, 2012): 148 installations >10 kWac with 36,56 MWac (average size of 247 kWac/installation) added. Growth for the market segment up till 10 kWac has been 7.577 new installations with a size of 47,29 MWac (average size app. 6,24 kWac/installation). Total "VREG-registered" additions in 31 days has been a very good 83,85 MWac and 7.725 new installations, or 2,70 MWac (249 installations) a day. February 2012 (between Feb. 1, 2012 and Feb. 29, 2012): 220 installations >10 kWac with 51,11 MWac (average size of 232 kWac/installation) added. Growth for the market segment up till 10 kWac has been a relatively low 4.727 new installations with a size of 24,59 MWac (average size app. 5,20 kWac/installation). Total "VREG-registered" additions in 29 days has been a good 75,70 MWac and 4.947 new installations, or 2,61 MWac (171 installations) a day. |

Growth rates in Flanders still remain much bigger than in the neighbouring Netherlands, that realised only approximately 11 MWp DC capacity of certified installations in 2010, and a volume of over 9 MWp of non-certified PV-systems in that year (total: 20,4 MWp grid-connected plus 0,3 MWp autonomous systems) according to data released by CBS / StatLine (summer of 2011; data accuracy questioned by Polder PV) in combination with earlier published numbers from CertiQ. For 2011 up till March 1, 2012 only the preliminary "certified" volume is known, 25,3 MWp. If 35% of new year volume has been realized without certification (comparable to the level of 2010), total year volume in 2011 could reach a level of 33,0 MWp, of which 11,6 MWp might be uncertified. This is only a fraction of the actual Flemish market volumes.

Market

growth 2011

Since the Feb. 28, 2011 report several new data have become available

in various new documents on the VREG website. One of the most interesting

of these is the "adjusted" volume listing per year (since 1985),

with the latest available data for the number of PV-installations newly

installed in the year under consideration. And considered eligible for

receiving green certificates by VREG. The original year of installation

is the marker date in these documents. Later expansions of installations,

a practice common with a growing number of PV-owners with appetite for

more, are considered separately. If that expansion has an official installation

date in a later year, it is assigned to that year.

For the evolution of the data in these lists (Feb. 28, up till March 2, 2012 reports), I constructed this detailed Excel table in which the "backlog" assignment per year can be followed in detail, for number of installations as well as for their accumulated new capacity:

(Graph/table

above, CLICK on image for

enlargement)

In this screendump of another spreadsheet a comparison is made between

the listings of PV-installations assigned to their (first) year of installation

as approved by VREG in the subsequent month reports (Feb. 28, Apr. 5,

May 2, June 1, July 1, August 1, September 1, October 1, November 1, December

1, 2011, January 1, 2012, February, 1, and March 2, respectively, from

right to left). In red numbers, changes are given with respect to the

data provided in the previous month report. Sometimes even negative numbers

result from that subtraction (e.g., for - small - PV-capacity changes

in earlier years), possibly referring to removed or destroyed installations

(or otherwise unknown factors).

However, the most significant changes are positive, and sometimes dramatic for the years 2009-2010 and, of course, 2011. For the last report (March 2, 2012), changes were again almost exclusively for the years 2009-2011: 267 kWac (2009), 8,000 MWac (2010) and again a considerable new volume of 58,145 MWac for 2011. Plus 0,06% (2009), 2,4% (2010), and 9,9% for 2011 with respect to the accumulated capacities in the previous month report. 2012 saw its first additions, still a very moderate new volume of 9,305 MWac. It remains to be seen how the market will develop, with another new degression of the value of green certificates already in place (Jan. 1, 2012).

From the detailed table follows that in total 75,7 MWac of "accumulated PV-capacity" has been added in the latest, March 2, 2012, report, with 4.947 new installations. And that the largest part of that volume, 58,1 MWac (3.096 installations), 76,8% of the new capacity reported by VREG, has been added to the previous volume of 589,6 MWac accumulated for 2011 in the February 1, 2012, report. The second largest volume has been assigned to 2012 (9,3 MWac or 12,3% of new volume in the latest report). The - minor - rest has been assigned to 2010 (8,0 MWac / 10,6%), and to 2009 (267 kWac / 0,35%). Some small changes (deleted capacities) have occurred in earlier years. Still, more installations can still be added afterwards, in particular to 2011, but even - in small volumes - to the years before. It is to be expected that growth volumes of 2011 will turn out to be even much stronger than shown in the present update. And, of course, that 2012 volume will rise sharply, with flat and low module prices and overcapacities in the global market.

Up till the March 2, 2012 report an accumulated new capacity of 647,8 MWac for 2011 has now already been documented. Which is a strong 88% over the new volume in 2010 now known. And already 43% more than the previous record year 2009. Hence, in contrast to what might haven been suggested before, 2011 has been an excellent year of PV-market growth for Flanders, despite the already implemented feed-in degressions. This has been regulated as a diminishing value of the green certificates obtained from the regional net managers by the PV-system owners, with degressions as per January 1, July 1, and October 1, 2011. Leaving only 9 Eurocent/kWh for installations >250 kWac, and, as per Aprl 1, 2012, 23 Eurocent/kWh for smaller installations.

Calculating with a factor 1,1 to obtain an estimated new DC capacity for Flanders in 2011 (713 MWp), this - still "preliminary" - volume for 2011 is probably almost a factor 35 times that of the accumulated new volume (20,4 MWp grid-connected) in the twelve months of 2010 in neighbouring Netherlands (which has a population 2,7 times bigger than that in Flanders, later CBS data not yet available). With more capacity to be added on the horizon.

Graphs Flanders PV market as compared with Netherlands.

With the January 1, 2011 report, it has turned out that the VREG registrations have resulted in a historical "marker" event: Flanders surpassed the ("official") 100 Wac/inhabitant accumulated installation milestone in that report (with later revisions bringing more capacity for earlier years that marker shifts to a point earlier in time). With respect to the March 2, 2012 report, with 1.549 MWac of registered capacity, the 6,25 million inhabitants of the Flanders region (exclusive of Brussels) each had 247,8 Wac virtually installed solar inverter capacity. Using a factor 1,1, this could result in a virtual, average, modern, powerful 273 Wp PV-module on the roof of each inhabitant. For preliminary data up till 2011, see the interactive figure given below. In this figure also the deplorable situation in the Netherlands becomes evident once again (green columns), with only approximately 6 Wp/inhabitant at the end of 2011. Even if the as of yet totally unknown "non-certified volume" for that year is taken into account as an optimistic, and speculative 20 MWp (total new volume for 2011 put at 45 MWp incl. 21 MWp certified/CertiQ, and including 10 MWp non-certified "Wijwillenzon" projects, capacity additions uncertain), accumulation end of 2011 would reach only 128 MWp, and in Netherlands only some 8 Wp per inhabitant would materialise. Only 3% of the per head volume in Flanders...

It is important to emphasize that Flanders has started only seriously in 2006 with PV market expansion as the first feed-in legislation was introduced in that year. Netherlands already has considerable experience with PV-installations since the end of the nineties of the previous century, with famous, internationally renowned (and very expensive) projects. However, stifling political desinterest, powerful, natural gas and nukes loving bureaucrats with their own "visions" of the energy future, and continuous sabotage by parties deeply involved in fossil-based energy generation has prevented succesful implementation of "working" legislation. As a result, Netherlands has fallen back onto the 14th position in accumulated volume of PV in EurObserv'ER statistics in 2010.

Accumulation

up till 2011

The following graphs are updated with the data from the March 2, 2012

report. The numbers give the extrapolated MWp nominal capacity (hypothetical

factor: MWp = MWac * 1,1) based on the published month reports by VREG.

For Flanders, in particular the accumulation for 2011 still can change

considerably. The Dutch data up till 2010 seem to be more or less "fixed"

by CBS, but the webmaster of Polder PV has doubts concerning the accuracy

of those data since most PV-systems in the Netherlands are never monitored

and many thousands of small installations have never been officially registered.

The data for 2010 apparently have not changed (CBS data update

in September 2011).

2011: preliminary

results (NL: 2011 only including known certified capacity)

ROLL-OVER IMAGE (above).

Moving the mouse pointer away from the image shows the absolute grid-connected

PV capacity accumulation per calendar year, as provided in monthly reports

(note: most recent data can change afterwards). Note that capacities

are given on a logarithmic Y-axis! Given directly in MWp by CertiQ in

Netherlands, but calculated by Polder PV from the AC power registrations

by VREG for Flanders by multiplying those data with a factor 1,1*.

All installations certified for Flanders, but only a relatively small,

app. 33% portion (end of 2010 over 29 MWp out of accumulated volume

of 88 MWp) certified for the Netherlands. Status for 2011 is not yet

known, only certified new capacity could be extracted from CertiQ data

(also not yet certain): 21,5 MWp. Dutch data show "final"

data up till 2010 (CBS year report,

not changed later). VREG data for 2011 are also expected to be revised,

as well as data for earlier years, although the latter will only change

with small volumes.

Moving the mouse pointer over the image gives the calculated capacity accumulation per inhabitant ("per capita" or "pp."), also with a logarithmic Y-axis scale. Both images show strong growth of the Flanders market as compared to the sluggish development in the Netherlands in the last years - even under a so-called new "incentive" regime ("SDE"). Calculated accumulated grid-connected capacity for Flanders end of 2011, based on revised data in the March 2, 2012 report: approximately 1.692 MWp of nominal (STC) capacity (1.538 MWac accumulated AC power). A roughly estimated 16 times as much as the capacity that might have accumulated for grid-connected PV-systems end of 2011 in the Netherlands (exclusive not yet known uncertified installations for that year).

Accumulation

2011

In the next, mouse-directed roll-over image progress in 2011 is monitored,

based on the accumulation data given by VREG in the separate month reports

for all renewable electricity generating options. Since in those reports

the older progress data (for previous months) are not updated, the first

reports of the year always have "outdated" accumulation data.

Hence, for the January 2011 accumulation the outcome (an estimated 737

MWp in published month report) is - considerably - lower than the estimated

"updated end of 2010" value (see graph above: 980 MWp). Therefore,

the results for the previous month reports in 2011 have been given in

hatched columns. The final month gives the "preliminary actual

status" derived from the most recent month report analyzed here,

the one date-stamped March 2, 2012.

ROLL-OVER IMAGE (above). Moving the mouse pointer away from the image shows the DC grid-connected PV capacity (MWp) accumulation per month in 2011 (up till Jan. 2012), as provided in monthly reports (note: most recent data can change afterwards). Note that Y-axis is at a normal scale (previous graph is with logarithmic axis!). For Netherlands, the non-certified, not centrally-registered volume added in 2011 is as yet completely unknown. Only the installations officially registered at the CertiQ office are known and published on a monthly basis. These are exclusively PV-systems having a certified production meter ("bruto productie meter", for the old MEP and, in particular, SDE incentive regimes).

Poor

market conditions Netherlands >> low growth rate PV

The Dutch (NL) PV capacity accumulation is uncertain. The last data

for 2009 has been 62,5 MWp of grid-connected installations (CBS year

report). The new StatLine data and the CBS year report 2010 give almost

20,4 MWp of new grid-connected volume for 2010 (based on a questionable

once in a year "request for information" with only a selection

of installation companies). Which brings the accumulated grid-connected

volume at

82,7 MWp, end of that year. The accumulations for the months in 2011

given in the graph above are the 82,7 MWp mentioned plus the new certified

additions by CertiQ in their continuing month reports. At the start

of March 2012, still only 108,0 MWp of grid-connected PV-capacity has

accumulated. With unknown "uncertified" MWp's missing since

the start of 2011, that have never been registered in a central database

anywhere. In view of developments on the "uncertified" market

in Netherlands (possibly 35-45% of total market installations in 2010),

finally the long-awaited threshold of 100 kWp of installed accumulated

capacity might have been reached earlier in 2011. Although it is impossible

to tell when exactly that long awaited "mile-stone" might

have been reached (presumably somewhere in June or July)...

Note that apart from that segment, up till 2010 only 5 MWp of autonomous systems were accounted for in the Dutch CBS data (with an apparent decrease from max. of 5,3 MWp in 2007). These poorly known off-grid systems are not taken into account in my reports for the grid-connected market, which is dominant in all aspects.

Comparison of market development of grid-connected PV-installations in Flanders (blue) versus the known volume in the Netherlands (light green dashed columns) is shown in the graph above. The new "incentive" regime in the Netherlands (SDE, started on April 1 2008, in essence a combination of net metering [poorly documented in Law since July 2004, even in an upgrade earlier in 2011] and a variable feed-in allowance changing each year) is so bureaucratic and full of various restrictive market caps, that progressive, strong growth has remained an illusion. The fourth regime, SDE 2011, has depleted it budget at the beginning of 2012, but almost all capacity has yet to be realized. Including the 50 MWp "approved" PV projects that would receive only a few Eurocents subsidy per kWh produced on top of net metering. If that is possible, since this can only be achieved on premises with a connection capacity up till 3x 80 Ampères (this could mean that PV-systems cannot go far beyond 50 kWp to be able to comply for net metering).

From renewed calculations of published graphs (new calculations published here) only app. 6 MWp had been included in 2009, and approximately 11 MWp in 2010. Newly added certified volume in 2011 has been over 21 MWp (preliminary CertiQ data that might be adjusted). Most probably, this volume will increase slightly, since "permits" issued by Agentschap NL dictated a realisation date in 2011 for many installations, and realized volumes may be adjusted in a later year. However, many allowances will possibly never materialize for a number of reasons. Market conditions for photovoltaics in Netherlands remain deplorable, in particular for bigger projects.

From the start of the lottery that the SDE regime has been for PV, a growing number of system buyers did not even apply for the new SDE subsidies in the Netherlands because of stifling bureaucracy, and many uncertainties. An increasing number of people and companies have acquired uncertified, mostly unreported PV-systems and still do so in increasing numbers, triggered by ever lower module prices and increasing awareness for solar energy among Dutch civilians and smaller companies. In their year report for 2010, CBS published data resulting in approximately 20,7 MWp of capacity sold to installers in 2010, 20,4 of which would be grid-connected. That suggests that app. 46% of capacity sold did not enter the CertiQ database (year report: app. 11 MWp new in 2010). In addition, it must be stressed here that those installations do not have a certified production meter, and that the green electricity produced is probably not registered in any central register.

The new conservative, nuclear fission loving minister for economic affairs in the Netherlands, Maxime Verhagen, dictated end of November that in 2011 all state-induced incentives for "small-scale" photovoltaics (up till 15 kWac) would be completely abandoned (excluding the remaining, poorly regulated net metering), and that the economic basis for incentives for larger installations would turn out to make that a negative business case for almost all projects if no other financial incentives (mostly taxation profits: EIA, VAMIL, MIA) can be found... A plethora of - often short-lived - new "market initiatives" has emerged since then. The national PV-market is in total chaos, and an initiative for buying cheap Chinese modules and inverters (app. 13-14 MWp suggested early in 2011) by a foundation (Urgenda / Wijwillenzon.nl initiative 2010-2011) has met with strong criticism by - mostly experienced - installers. These installers feared that their hard-earned market shares are out-competed with heavily subsidized Chinese hardware dumped on the ever-small Dutch market. Some 6 MWp of that volume (for private house owners) would have been realized in a few months time, starting in May 2011. Actual realisation data of this initiative remain enigmatic, the initiative has been extended "for one more time", after which it would be stopped ("the market has to pick up the idea of collective import", so it is said, several "initiatives", each with its own peculiarities, followed soon...).

Since then, the "collective buyer" actions have exploded in the Netherlands, many in the eastern province of Overijssel giving a lot of extra incentives. On March 28, 2012, I have counted already 42 (!) collective buyer projects, varying from small to relatively big (e.g., "Zon Zoekt Dak" could generate over 10 MWp, if all reservations will lead to orders). All these projects will not deliver "certified" installations that should become known to CertiQ. Hence, it is possible that far more "uncertified" capacity will be added in 2012 than the SDE projects ("certified", and with "bruto productiemeter") might bring.

In

contrast

Flanders has introduced an exceptionally attractive package of

"Germany-like" (certainly not identical) kWh incentive for 20

years (up till 2009 45 eurocent/kWh, fixed tariff for existing installations,

lowered to 35 eurocents/kWh in 2010, 33 eurocents/kWh up till end of June

2011 for installations <1 MW. As of July 1, 2011, the scheme encompasses

30 eurocents/kWh for installations <1 MW, and 24 eurocents/kWh for

installations >1 MW. With further strong reductions as of October 1,

2011, and January 1, 2012, already decided

upon, and, in the meanwhile, implemented as such. April 1 a next degression

step will be implemented.

This, added with accompanying net-metering up till zero on a yearly basis for the smaller installations (max. 10 kW inverter output), and, for a long time, very interesting tax incentive measures (these have, finally, been abolished for smaller installations in the new year). The Flanders market started to grow like nuts in 2008-2009, as revealed by updates by VREG, showed slower, but still good growth in 2010. Even with the strong, step-wise degressions of the value of green certificates, market volume for 2011 is already much bigger than that in 2010. In 2011, "social cost" discussions (hotly contested by branche organisation PV-Vlaanderen) have eroded political will to further support photovoltaics forcefully. The social Minister Vandenbossche has openly "admitted" that PV in Flanders has grown too fast, that strong support for developing PV apparently has been "a mistake", and she has pleaded openly for more wind power on Flemish territory.

"Vlaanderen is een “energetisch ontwikkelingsgebied”." Willy Lievens van educatief centrum Zonne-arc, in een artikel over zijn initiatief in Duurzame Energie van augustus 2001, en aanhanger van de Trias Energetica (besparen boven alles), zal mogelijk zijn mening daarover enigzins hebben bijgesteld anno 2011... |

Flanders: PV has most capacity installed in renewable electricity

© Data VREG, March 2, 2012 report

(Graph

above)

Already

in the end of November 2009 report by VREG, solar electricity had

reached the largest nominal electrical capacity of all considered

renewable options in Flanders, and its impact has increased further

up till the end of January 2012. Output in kWh, of course, is much

lower in relation to other renewable options because of the relative

low specific production per kWac (PV installations are unable to produce

anything at night, it's in their "nature"). However, this

graph shows how large the impact on the "renewable electricity

market" has become with respect to photovoltaics in this relatively

small, Dutch-speaking part of Belgium. A sizeable 58,3% of total "nominal"

capacity (2,66 GWe) installed is the most democratic type of electricity

generation, "power to the people" PV.

Renewable electricity generation from wind on land (blue column), which temporarily took over the second place in July 2010 with the report of 4 new facilities, has fallen back to a 3rd position according to the VREG data. Only 46 MW of windpower has been added in 2011, but the March 2, 2012 report added a good 39 MW (3 new projects). It is expected that, with the building of an off-shore wind parc (and increased political support for wind on land over solar by Flemish authorities), this situation could change dramatically in the near future. There is, however, also a highly controversial old coal-plant that is refurbished by co-owner Electrabel as a pure "biomass-firing" plant fed with imported Canadian wood chips. This company, having a rather bl(e)a(c)k reputation in Belgium, and de facto a French-backed Belgium energy monopolist (under the umbrella of GDF-Suez), will obtain huge amounts of feed-in incentives extracted from the purses of all Flemish people (note that end of February 2012 Electrabel also has 4,4 MWp in 15 PV-projects in their portfolio). A move that has loosened the tongues of many people there, Polder PV reported on November 26, 2010, and on December 11, 2010...

The January 2012 report also came up with another surprise: 150 MWe of capacity has been added for the category "biomass from agriculture or forestry".

Note, that in the February 1, 2012 update, a 10th "variety" has been included by VREG, biogas produced my means of "mainly" agricultural sources. This option was not present in previous reports. The same applies to an 11th "variety", introduced in the March 2, 2012 update: biogas produced from green domestic waste ("GFT") with a composting installation (1 installation, 1,4 MWel).

Flanders: distribution among PV-installations >10 kWac

One of the most interesting sections in the statistics reports by VREG is a detailed overview of the individual installations for the production of renewable electricity (for which green certificates are issued). Up till end of 2010, these data were published as - mostly - monthly pdf documents with a full list of all the installations. This list does not include the small (most PV) installations up till 10 kWac, but it gives a fascinating overview of spread in installation size and companies and a variety of institutions (and communities) involved, as well as their location (community with zip code). End of January 2011 for the first time this list was presented as an Excel file, facilitating update work. Regrettably, the publication format returned to pdf and, later, also Word documents, hampering quick analysis of changes between reports published. In particular checking out all changes in converted Word >>> Excel files is a lot of work, and has to be done with care.

Polder PV analysed the latest March 2, 2012 report (with a total of 3.382 entries on 256 pages...) in detail, extracted the relevant data for PV installations, and summarized the findings in detailed graphs below*. Update >10 kWac listing: March 2, 2012.

* Since data, in the past, have been - carefully - extracted from pdf documents, minor errors might have been included in the spreadsheets constructed by Polder PV. They will, however, have little effect on the evident trends published in the graphs published below.

(a) Accumulation of >10 kWac installation capacity and numbers

2011 - a year coming to an end

Accumulation of number of registrations and of total capacity of PV-installations (MWac) up till the last VREG report, March 2, 2012 (situation given in that report: end of February/start of March):

|

©

Data: VREG; Graph:

© Peter J. Segaar/Polder PV,

Leiden (NL) |

Adjusted numbers

exlusive of Loghidden City

In the December 1, 2011 report, surprisingly a 23rd new large

Katoen Natie Kallo (Kieldrecht) Loghidden City sub-project ("delivered"

end of 2009) has been added (652 kWac "Ghendt Handling And Distribution

NV"). A last entry by Katoen Natie had been given in the November

2011 update for a project in the Antwerp harbour region at the Noorderlaan

directly north of the center (east-bank of Schelde), but that one, and

also 3 later projects in that area (totalling 2,2 MWac), do not belong

to the big "40 MW multi-site Katoen Natie project" that has

been in the news for a - suprisingly - relative short time.

The previous last two entries for that famous 40 MW Katoen Natie project (biggest in Benelux, largest roof-top project world-wide) were published much earlier, in the April 5, 2011 report (see special for details about that project). Average size for the >10 kWac category is now 211 kWac per installation for all accumulated entries recorded by VREG in the March 2, 2012 listing. The following basic data for the >10 kWac category exclusive of the "special" single-site Katoen Natie Loghidden City logistics complex in the western harbour area outside of Antwerp (>27,9 MWac) could be extracted from that updated listing: 3.360 installations (or: separately registered portions of large installations) with a total of 686,3 MWac and an average system size of 204,3 kWac per installation.

Big

Players and large installations registered

On top of Katoen Natie sub-projects discussed further below, several other

big projects have been included in the VREG lists in 2011 and 2012. Many

of them have already been realised in 2010.

In the January 1, 2011 report, a 1,012 MWac project bij Stas BV in Sint-Truiden was registered, and three portions of the Katoen Natie project in the Sint-Kruis-Winkel area bordering Desteldonk in the Gent sea terminal region (total of these 3: 4,755 MWac).

No further big (sub)projects appeared in the January 31, 2011 update. However, again two new projects emerged in the February 28, 2011 update. A 1,05 MWac project by Vergalle NV in the village famous for its Spring cycling classic (Ronde van Vlaanderen), Oudenaarde. And a new Seaport Terminals N.V. installation of 1,485 MWac on three warehouses at Mai Zetterlingstraat 70 in Desteldonk. Strangely, that is the same address as a previous entry of the same size under the same company name, with the same zip code, but allocated to Sint-Kruis-Winkel, at the same location just northeast of the Gent harbour region. On that same address 3 other entries of huge installations sized 1,1-2,2 MWac under daughter companies from Katoen Natie (Polymer NV, Sabeen NV) have been included by VREG (however, on other warehouses at this address). It is not yet clear if the "Seaport Terminals N.V." entries actually belong to the famous Katoen Natie project, or that it really is a separate company having done the same thing as their neighbours once they saw how lucrative the solar megabusiness was (in 2009-2010).

The April 5, 2011 report introduced 2 new Katoen Natie entries in the Desteldonk region of Gent (3,11 MWac), and 2 new installations by Invictus, one in Niel (Invictus Boom, 1,084 MWac), and one in Puurs (Invictus Puurs, 2,26 MWac). The latter project possibly has been (co-) financed by world's "most sustainable" bank, the Dutch Triodos Bank (having its roots in the antroposophic movement) via their Triodos Renewables Europe Fund in which the webmaster of Polder PV also has a small participation. The annual report 2010 of this fund claims a "Solar plant Puurs" of 2,3 MWp (apparently DC capacity reported) in its portfolio. Puurs lies just south of the river Schelde, and west of Willebroek, where sustainable bank competitor ASN Bank from the Netherlands co-financed a 2,6 MWp PV-project in conjunction with nuclear power plant co-owner Delta from the same country.

There has also been an upgrade of a WDP installation in Boom, adding almost 500 kWac to reach a total capacity of 1.911,4 kWac, while at the same time the long-time mysterious 3,6 MWac entry for Serge Hardy Lanaken (for which not one project detail has been published) has been deleted from the VREG records. It apparently never materialized, pressing further questions concerning the validity of a "VREG-registered" status of (large) PV-installations. Of course, all these tiny, but crucial details have an accumulated impact on the reliability of the PV-market statistics "extracted" from the VREG records (the only "reliable" and verbose dataset publicly available for Flanders).

The most surprising additions to the >1 MWac list however, were two entries for a Zonnecentrale Overpelt NV, 6,20 and 6,22 MWac in the April 5 update, that each outstripped the "former ground-mounted champion" Heusden-Zolder system of 4,704 MWac (Flemish province of Limburg) that received its first green certificates on December 19, 2008. Apparently there has been a mistake in the April 5 list, since the "6,20 MWac" block could not be found anymore in the May 2, 2011 update. An internet search revealed that a single block of 7,6 MWp (DC:AC ratio 1,22) is built on the premises of metal producer Nyrstar in Overpelt (see photo and info). This big PV-plant has been formally accepted by VREG on December 28, 2010, got its first green certificates on Jan. 14, 2011, and is reported to be connected directly to the high-voltage ELIA (DNB) power grid (not a surprise given the fact that Nyrstar is a metal producer using huge amounts of electricity). Overpelt is situated in the Flemish province of Limburg alongside the Zuid Willemsvaart canal in a region bordering the southern province Noord Brabant in Netherlands.

In the June 1, 2011 month report a large number of new installations were registered, including for the >10 kWac category. 8 installations bigger than 1 MWac were reported, with an accumulated AC power of 10,8 MWac. The largest has been a 1.673 kWac installation by Maasland Groefuitbating NV, SW of Opglabbeek (in Flanders province of Limburg). This company seems to be related to Group Machiels that has also been involved in several other big projects, such as the huge 7,6 MWp Nystar project in Overpelt.

The July 1, 2011 report introduced three installations in the biggest category, one with exactly 1 MWac, Orka Power NV in Bornem (SW. of Antwerp), that apparently has been rapidly sold to ING Equipment Lease Belgium NV, as this was the name of the project holder in the August 1 update for this installation, under the secondary name Orka Puurs NV. Two further >1 MWac installations were reported. One for the project developer Solarpulse III NV, 1,022 MWac in the vicinity of Bornem, Temse on the north bank of the river Schelde. And a 1,0764 MWac installation from Stas NV in Sint-Truiden, SW. of Hasselt (province of Limburg). Stas has already 5,5 MW of PV-projects in their portfolio shown in the VREG data.

The September 1, 2011 update reported a large contingency of bigger installations. Most notably, 6 installations bigger than 1 MWac were introduced: (1) 1,102 MWac Concorde NV Wervik in Houthulst (West Flanders north of Ieper), (2) 1,173 MWac Mechelse Veilingen project in Sint-Katelijne-Waver south of Antwerp, (3) 1,334 MWac Fabricom NV in Dendermonde (East Flanders), (4) 1,4904 MWac Suncop II NV in Hingene (near Puurs, SW. of Antwerp). Scaling further upwards, (5) the 4,05 MWac SPS FIN BVBA - SPS Solar Tunnel (Infrabel) project on top of the HSL high-speed train tunnel along the E16 motorway between Schoten and Brasschaat, east of Antwerp (Enfinity project with 16.000 PV-modules). And, finally (6) 4,536 MWac Zonnecentrale Tongeren NV, a huge project with PV-roofs by the famous Group Machiels that developed this massive "protection for parked new cars" on one quarter of the 142.000 m² large premises of the Hödlmayr parking in the industry park Overhaem in Tongeren (Flemish Limburg province). Installer is the famous company IZEN, who claims a yearly yield of 4.114 MWh from the 21.600 PV modules and 312 installed top-class Refusol inverters (specific yield expected: 907 kWh/kWp.year). An interesting and informative video made for IZEN can be observed on Youtube (this link).

|

^^^ © Orka (Melle, Belgium, formerly known as Invictus). Photo from project page on website Orka |

In the October

1, 2011 listing, again a suprising 9 installations larger than

1 MWac materialised (in addition to a lot of PV-systems in the 500-1.000

MWac range). These were: 1,224 MWac Gobo Europark 27 in

Lanaken, 1,5 MWac Reynaers Alumunium (Duffel), 1,5 MWac Van Moer Group

NV (Zwijndrecht), 1,55 MWac ING Equipment Lease Belgium NV - Sun Invest

III NV (Desselgem), 1,613 MWac Karel Mintjens NV (Malle), 1,628 MWac Masabi

BVBA (Erembodegem), 2,805 MWac Bruno Invest BVBA (Munsterbilzen), and

3 MWac SOTIK BVBA in Schaffen. The largest new installation reported,

was, however, part of one of the many ING Equipment Lease Belgium NV projects.

Three different entries for that large flat roof installation are included

in this report (1x 986, and 2x 1.054 MWac), adding up to 3,094 MWac. That

is not yet the total volume realized there, since the Orka

Harelbeke NV project in the city with the same name (NE of Kortrijk,

West-Flanders), is reported to have a size of 5,004 MWp (nominal DC power,

17,871 Suntech modules of 280 Wp). officially installed on the 30th of

June, 2011. One day prior to the first law-enforced strong degression

of the value of the green certificates for solar electricity... In a personal

communication with an employee of the system builder, Dutch (Deurne, NB)

Oskomera Solar Power Solutions, I was later informed (begin November 2011)

that only 3 MWp had initially been connected to the grid. The rest is

awaiting extension of the grid capacity, which should be realised end

of 2011...

The November 1, 2011 update had less larger installations, but there were 3 PV-entries >1 MWac: (1) a somewhat surprising new Katoen Natie project, 1,02 MWac, under the "flag" Katoen Natie Bulkterminals NV, this time in the centre of Antwerpen (east-bank of river Schelde, see further below). (2) a 1,1 MWac Prosolar Invest 2 NV installation in the northern harbour area of Gent. This biggest addition sofar brings total "Prosolar" portfolio in Gent on 1,77 MWac (6 entries). Finally (3) a Dufsun PV-system with a size of 1,6274 MWac in Duffel (prov. Antwerp, along Nete Canal).

In the update of December 1, 2011, only one big installation appeared, a 2,34 MWac installation by ING Equipment Lease Belgium NV, built by Orka (former Invictus) in Eindhout (prov. Antwerp) along the Albertkanaal.

To end the year in this preliminary overview, the January 1, 2012 report came up with another spectacular 13 entries with sizes over 1 MWac (in addition to 35 new entries in the category 500-1.000 kWac, 46 new entries between 250 and 500 kWac, and 83 new entries between 100 and 250 kWac):

4

MWp PV-installation on flat roof of corrugated carton producer Soenen

in Hooglede near Roeselare (West Flanders). A project realised by

Edison Energy under the flag Ed.Proj. Epsilon NV (entry appeared

as an 3,38 MWac installation in the VREG January 1, 2012 update). Photo © Edison Energy (project page) |

|

The first 2012 month report, the February 1, 2012 update revealed new entries > 1 MWac: 1,428 MWac PVZG_Solarrise BVBA - Associated Weavers project, which has an accompanying 924 kWac project. The 2,352 MWac project is to be found in the bilingual village of Ronse/Renaix (East Flanders). A 1,5 MWac installation by Zandvoorde Green Invest CVBA - Dumoulin is to be found in Roeselare (West Flanders); it is accompanied by a 576 kWac (roof) entry under the same project label, making it a 2,076 MWac project. Than, also in Roeselare, there is an 2,12 MWac installation by Greentile bvba - Aldi, accompanied by a 391 kWac entry, combining this to a 2,511 MWac installation. Earlier, on an Aldi premises in Erpe-Mere, a 840 kWac project was reported under the same Greentile umbrella. Finally, the biggest new installation entry in this report has been a large 2,46 MWac project with "super investor" ING Equipment Lease Belgium NV at the premises of Kuehne & Nagel in Geel (province of Antwerp).

March 2, 2012 update included several >1 MWac projects: 1,224 MWac Ecorus Invest project in Mol (eastern part of prov. Antwerp), 1,387 MWac SolarPulse VI NV in Alken (Prov. Limburg), 1,428 MWac Solarrise BVBA - Associated Weavers in Ronse/Renaix (Oost Vlaanderen), the second of a monster project already including a 924 kWac installation, hence total volume now 2,352 MWac. Furthermore, three large installations for Aldi under the Greentile project (now encompassing 5 locations with 6,6 MWac): 1,5 MWac in Heusden-Zolder (Limburg), 1,76 MWac in Zemst (Vlaams Brabant), and a 2,12 MWac installation in Roeselare (West Vlaanderen). Finally, a 1,564 MWac Futech BVBA installation in Heusden-Zolder, and two large ING Equipment Lease projects: 1,93 MWac Green-Bel - Cras in Waregem, and the biggest, ISP1-RG NV/VMW in Kluizen (ING's "ISP1-RG" portfolio now contains 10,33 MWac).

The long list shown above clearly indicates that many investors with some money to spare were very keen on realising big projects in 2011 (none has its date of approval in 2012). It remains to be seen how enthousiastic they will be in 2012, under extremely restrictive feed-in conditions and green certificates whose value has dwindled to "only" 9 Eurocents/kWh for installations >250 kWac...

The enormous Katoen Natie project remains, of course, by far the biggest - roof mounted - installation in the Benelux, see the special further below.

Special: More big players in the Flemish market A number of big players act with large, mostly roof-top PV-installations on the Flemish PV-market. With a lot of money to spend (real estate owners Katoen Natie, WDP), highly professional personnel keen on intelligent roof projects and concepts (e.g., Enfinity), long experience in the installation sector (e.g., SolarAccess, mostly working for big project developers under whose name the project is listed in the VREG records), or good contacts with financial parties, they have realized many large PV-systems in a relatively short period of time. Most of these projects will see very interesting "internal rates of return". Although with politically decided strong degression of feed-in tariffs, in particular for these large projects, the number crackers with these companies will have to redo their homework to be able to realize economically viable superprojects in the near future. Falling module prices and BOS ("balance of system") costs will certainly help to that end, but political support for solar appears to be dwindling due to one-sided "social cost" discussions. An example of companies involved has been extracted from the data available in the March 2, 2012 report. I made a selection of some of the most notable big players on the Flemish market, exclusive of the Katoen Natie super project delivered end of 2009 (38,43 MWac positively identified as such) which is considered here as a "unique case" (see special). The source data are published by VREG on a monthly basis in their >10 kWac project listing. In the table, first the main company name (sometimes appearing under a slightly different name), in the second column the number of big PV-projects sofar realised by that company (selection), and in the final column the total capacity involved in these projects (in kWac accumulation). This table (extract) adds up to 284 MWac, which represented over 18% of total VREG-registered market volume in Flanders, March 2, 2012 (1.549 MWac). Mostly projects of hundreds of kWac or even over 1 MWac are included here. The listing is not exhaustive and known newer projects are not yet included.

The table lists a variety of companies, ranging from an energy utility deeply involved in huge amounts of fossil and nuclear power (Electrabel, actually Belgium's super monopolist under major French stake-holder Suez), PV-specialist companies like Enfinity (famous for its fast rise, and active in many countries including China), Belfuture, and Zonnecentrale. But also big retailers like Colruyt, Ikea, and, more recently, Aldi, are highly active, and, as an example of further potential, at a very benign level realizing smaller projects on schools etc., several Flemish communities ("Gemeentes & Steden div."). Another "very special case", marked in red, is the bank consortium ING (originating in the Netherlands) that has realised - or aggressively acquired in the course of time (in particular during the second half of 2011) - a staggering volume of 77,9 MWac in 195 entries distributed among app. 128 projects and -portfolio's (that used to be only 34 MWac in the Dec. 1, 2011 report!), almost all via their Equipment Lease branche in Belgium. More projects will most probably follow in later updates, it seems that ING has become a "wholesaler" of big photovoltaic projects in Belgium. GFS Veurne is one of the few "big" free-field installations in Flanders (southwestern part of Belgium, close to the French border). It has been realised by Netherlands (Venlo) based Scheuten Solar (filed for insolvency in March 2012), together with Flemish project developer Green Fever, and the installation has a size of 2,7 MWp (DC capacity, represented by 2,58 MWac in the VREG records, in two different segments). The "Zonnecentrale" company is also very interesting. Only 8 installations have a total capacity of 21,0 MWac, a spectacular system average of 2.627 kWac per installation. The biggest one at that time is Overpelt 6,22 MWac. The other projects can be found in Beringen, Genk, Hasselt, Heusden-Zolder, Lommel and Maasmechelen (system sizes between 429 and 4.704 kWac). Later, the 4,5 MWac project in Tongeren has been added to their spectacular portfolio. Another striking player shown in this table is a big real property company (in Flemish: "vastgoedbevak"), the stock-exchange-quoted Warehouses De Pauw (WDP). It is represented with 12,4 MWac of large projects in the March 2, 2012 VREG listing, and the company is planning a volume of approximately 30 MW of renewable capacity [including windpower] on or nearby its own warehouses and other property to be able to exploit their business on a "CO2-neutral" basis at the end of "Kyoto" year 2012. In a press release dated April 28, 2010, the company announced it already had 10 MW of PV projects realised in 2007-2009, and that it was planning another 8 MW in a new phase that should end in the first half year of 2011. Hence, possibly more of their projects will materialise in coming VREG updates. Already 10 percent of the company's income (5 million Euro/year) is said to originate from the feed-in tariffs earned by these big PV-projects in a news item of August 25, 2010 (and others). Many people in Flanders think that is not the way things should go in Belgium. Because all electricity consumers pay a rate on top of their kWh tariff from which the green certificates are financed by the net managers. Including those for huge projects such as parties like WDP have realised or will build in the near future... |

(b) New installation capacity per month or in the VREG reporting period

An example of the new capacity per category is given below for the busy month, May 2011.

|

©

Data: VREG; Graph:

© Peter J. Segaar/Polder PV,

Leiden (NL) |

(c) New installation capacity per day in a specific VREG reporting period

In the final graph of this section the per day graph for the last period reviewed by VREG is shown. The graph shows the data for February 2012 (29 days):

|

©

Data: VREG; Graph:

© Peter J. Segaar/Polder PV,

Leiden (NL) |

Graph legend b and c: grid connected systems >10 kWac only; light green = number of new registrations (left Y-axis); light orange = new added capacity (MWac or kWac) in the period under consideration, per category. Graph (b) shows the total capacity and/or number of registrations in the given example. Graph (c) gives the capacity and/or number of installations per day in the last month, as calculated from the data reported by VREG.

In the last graph it becomes clear that in February 2012 again a considerable volume of new capacity has entered the VREG database, in particular for the larger installation sizes > 100 kWac. Due to some very big new installations, the market segment >1.000 kWac has been popular, 485 kWac on average reported per day in that month.

For the reported multisite project Katoen Natie 40 MW on 4 locations in Flanders, parts of which for the first time were incorporated into the VREG statistics in the July 2010 update, new portions were added in later updates, starting with August 2010. This huge project (cost: € 166 million), partly financed by loans from Dexia Bank and another, unnamed bank, is cut into a lot of smaller pieces between 0,21 and 2,22 MWac under various (new) company names. Most probably for financial reasons (optimal taxation issues related to the green certificates earned?). Up till the October 2010 update, only one installation was mentioned under the identifiable name "Katoen Natie Terminals NV", a second segment under that name followed in the November 2010 update, but all the other projects have been filed under different sub-company names (and in a later stadium designated as such by VREG in their installation records).

Two new entries appeared in the Jan. 1, 2011 update, under the location Sint-Kruis-Winkel (together 3,27 MWac), for Katoen Natie daughters Polymer NV and Sabeen NV. These are at the same installation location address for which already a "Desteldonk" entry was known, accumulating to 4,95 MWac for these 3 subprojects in the sea harbour region of northern Gent. In addition, a fourth entry was filed under the name Seaport Terminals NV (1,485 MWac) on that date, with Sint-Kruis-Winkel as location, and a fifth entry under the same name and with identical size in the Feb. 28, 2011 report, again with Desteldonk as location (all: same zip-code and same address...). The latter two are on exactly the same address, on different logistics halls (numbers 17-19 and 19-21; the three Katoen Natie entries here have been realized on halls 14-16, 26-30 and 36-39), but it could not yet be established if Seaport Terminals N.V. is a daughter company of Katoen Natie or not (VREG does not give a positive clue in this direction). As for now, the Seaport Terminals entries are not considered as part of the "Katoen Natie" super project.

Also note that one of the smaller (246,3 kWac) "Kallo (Kieldrecht)" segments has been earmarked with an address that is on the eastern side of the Vrasene Dock, more to the southwest of the Loghidden City complex (Land van Waaslaan Haven 1168/Saeftinghe Loods 5). So actually this is a separate location. Still no "hits" appear to have been included for the so-called Euroterminal of Katoen Natie to the southwest of that separate Vrasene Dock, that has once been said to be part of the whole 40 MW project.

Surprisingly, another sub-installation on the Kallo (Kieldrecht) Loghidden City terminal has been added in the VREG list of December 1, 2011 (652 kWac). That VREG report now lists 22 portions (27,92 MWac) for the Kallo-Kieldrecht location on the Schelde West-Bank (not on Antwerp soil, but nearby on the premises of the province of East-Flanders). In addition to this, now at least 5 portions for the Katoen Natie logistics terminal in the Desteldonk/Sint-Kruis-Winkel area have been identified by VREG as belonging to the Katoen Natie project in the harbour region northeast of Gent (also on soil of East Flanders; 8,12 MWac). The relation of the 2 Seaport Terminals entries in that area with the Katoen Natie project is not certain (therefore not included). Finally, 2 installations in the Katoen Natie terminal area of Genk in the Flemish province of Limburg in the northeastern part of Belgium are also reported with a total size of 2,15 MWac under the prozaic (and confusing) company name "Ghendt Handling And Distribution NV" (which has its main office in Desteldonk/Gent...).

Taking all together, a total capacity of 38,43 MWac for the multisite Katoen Natie project has now been registered with VREG and positively identified as such belonging to that project. Note that this volume (possibly 42,3 MWp?? if DC:AC ratio of the installations would be 1,1) might lie even beyond the 40 MW announced as early as end of 2009. If this is true, it seems that the whole superproject now finally has been included in the VREG database.